Current Mortgage Rates: The Unvarnished Truth for 30-Year Fixed Today

Refinance or Stay Put? Decoding Today's Mortgage Rate Maze

The Rate Landscape: A Statistical Overview

Alright, let's dive into the numbers. As of late November 2025, we're looking at an average 30-year fixed refinance rate hovering around 6.3%. (Zillow's data is the most consistent source, so that's what I'm using as my benchmark). The 15-year fixed is sitting a bit lower, around 5.7%. VA loans are offering the best deals, unsurprisingly, with 30-year rates dipping below 6%.

Now, before you jump on that refinance bandwagon, let's get real. These aren't the rock-bottom, pandemic-era rates that had everyone scrambling. We're talking about a market that's still significantly elevated compared to just a few years ago. As one source notes, rates in early 2025 were over 7%.

The key question: is this a true buying opportunity, or just a slight dip in an otherwise expensive market?

The Break-Even Point: A Personal Calculation

Here's where things get interesting, and where the standard advice starts to fall apart. The old rule of thumb – refinance if you can shave off a full percentage point – is simplistic, frankly. It ignores the individual's situation.

Let's say you took out a $400,000 mortgage at 7% two years ago. Refinancing to 6.3% sounds good. But you need to factor in the closing costs, which, according to the data, can range from 2% to 6% of the loan amount. On a $400,000 loan, that's $8,000 to $24,000. That's a hefty sum.

This is the part of the report that I find genuinely puzzling: most articles fail to quantify the time it takes to recoup those costs through monthly savings. A 0.7% rate reduction on a $400,000 loan translates to roughly $170 savings per month. If your closing costs are $10,000, it will take nearly five years to recoup your costs.

Are you planning to stay in the house for at least five years? If not, refinancing is a losing proposition.

What are the potential tax implications of refinancing, and how might they affect the overall financial picture? This is often overlooked, but crucial for a comprehensive analysis.

ARM Wrestling: The Adjustable-Rate Gamble

Let's talk about adjustable-rate mortgages (ARMs). The data shows 5/1 ARMs are currently around 6.17%. That seems like a decent deal, potentially even better than some fixed rates.

But here's the catch, and it's a big one: ARMs are a gamble. You're betting that interest rates will stay low for the initial fixed-rate period. And let's be honest, predicting interest rates is about as reliable as predicting the weather six months out.

If you know you're going to move before the rate adjusts, an ARM might make sense. But if you're even slightly unsure, stick with a fixed rate. The peace of mind is worth the slightly higher initial cost.

How do current economic forecasts factor into the decision of choosing an ARM versus a fixed-rate mortgage, and what are the potential risks and rewards associated with each option?

Is the Refinance Window Closing?

The sources suggest that there was some hope that the Federal Reserve rate cuts would translate into significantly lower mortgage rates. That hasn't happened. Rates have been "fluctuating slightly up and down," as one source puts it. In other words, Mortgage and refinance interest rates today for November 24, 2025: Fluctuating slightly without momentum they're stuck in a rut.

One article notes that the likelihood of another rate cut in December is "just under 80%." That's not a certainty. And even if the Fed does cut rates, there's no guarantee that mortgage rates will follow suit.

The reality is that the refinance window may already be starting to close. While it's impossible to predict the future, the current data suggests that waiting for a significant drop in rates is a risky strategy.

A Dose of Reality

So, what's the takeaway from all of this? The "current interest rates" are not a golden ticket to savings. They're a complex puzzle that requires careful analysis.

Before you jump into a refinance, do the math. Calculate your break-even point. Consider your long-term plans. And don't let anyone – including me – tell you that there's a one-size-fits-all answer.

The market is a data point. Your personal finances are the equation.

Data Doesn't Lie, But It Can Be Misleading

Related Articles

The Surprising Tech of Orvis: Why Their Fly Rods, Jackets, and Dog Beds Endure

When I first saw the headlines about Orvis closing 31 of its stores, I didn't feel a pang of nostalg...

Scott Bessent: Treasury Speculation, Trump Ties, and 2026 Recession Predictions

ABSOLUTE DIRECTIVE: TITLE FULFILLMENT ### Generated Title: Bessent's Recession Prediction: Bold Clai...

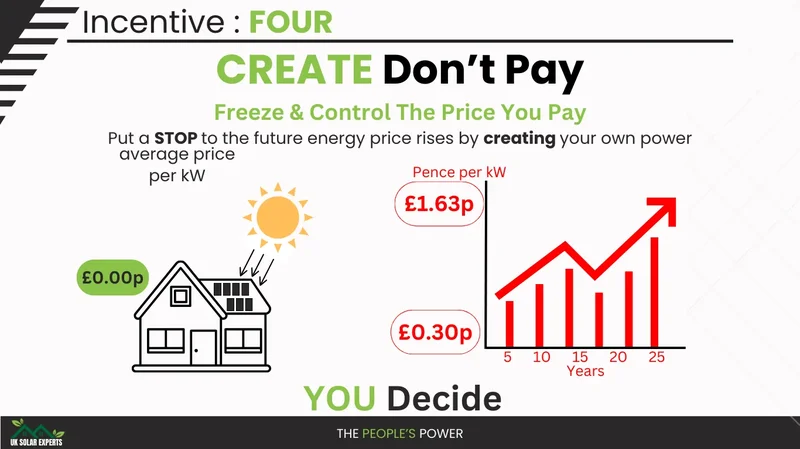

Solar Incentives: Who Benefits and What's the Catch?

Solar's "Silver Linings"? More Like Fool's Gold. Alright, let's get one thing straight: "silver lini...

Netflix Stock Split: What It Means for Earnings vs. Amazon

Netflix's 10-for-1 Split: A Masterclass in Financial Psychology or a Distraction? Netflix just annou...

American Airlines Closing? What's Really Going On and Why You Should Be Skeptical

American Airlines "Closing Rumors" Are Peak 2025 Bullshit So, American Airlines is "restructuring."...

Exxon's Earnings 'Beat' Is a Joke: Here's Why the Stock Is Actually Down

Exxon's Earnings, NBC's Cookies, and a Broken Webpage: My Brain Is Melting. Let’s just get this out...