Eli Lilly's Trillion-Dollar Leap: What's Driving Its Ascent and the Market's Future

[Generated Title]: Lilly's $1 Trillion Milestone: A Glimpse into the Future of Healthcare

Alright, folks, buckle up. We just witnessed something HUGE. Eli Lilly, a name synonymous with pharmaceutical innovation, just smashed through the $1 trillion market cap ceiling. They're not just selling pills; they're pioneering a new era of healthcare, and honestly, it’s got me buzzing with excitement.

A New Era of Health, Driven by Innovation

Let's be clear: this isn't just about a stock price. This is about the potential to redefine how we treat some of the most pressing health challenges of our time. Lilly's success with Zepbound and Mounjaro—both leveraging the power of tirzepatide, that amazing dual-acting molecule targeting GLP-1 and GIP—is a testament to the power of scientific ingenuity. I mean, $3.59 billion in revenue for Zepbound alone? That’s a 184% year-over-year jump! It's like watching the first rocket break free from Earth's orbit; it signals a whole new realm of possibilities.

And it’s not just about weight loss or diabetes. Lilly's also secured FDA approval for Inluriyo, a breast cancer treatment, and EU approval for Kisunla, an Alzheimer’s drug. They are attacking disease on multiple fronts, which is exactly what we need. The fact that Mounjaro has launched in 55 countries shows that they're not just focused on the US market, they're thinking globally.

Here’s the big idea: Lilly's success demonstrates a shift from simply managing symptoms to tackling the root causes of chronic diseases. It’s a paradigm shift. Instead of just treating the downstream effects of obesity and diabetes, we're finally starting to address the underlying mechanisms. This is like moving from patching up a leaky dam to reinforcing its foundation.

But let's be real, with great power comes great responsibility. As these treatments become more widespread, we need to ensure equitable access and address potential ethical considerations. How do we prevent these medications from becoming just another luxury for the privileged few? How do we ensure responsible prescribing practices? These are crucial questions we need to address as we move forward.

Lilly’s not just resting on its laurels, either. They're investing heavily in the future, planning to build two new U.S. manufacturing facilities and expand their existing facility in Puerto Rico. This shows a commitment to scaling up production to meet the growing demand for their innovative treatments. They also announced positive results from multiple Phase III trials of orforglipron, their oral GLP-1 pill. An oral weight loss drug? That could be a game-changer in terms of accessibility and convenience.

And the market is clearly taking notice. Investors are pouring money into LLY stock, confident that the company will maintain its leadership position. Eli Lilly Stock Surges 33% in 2025, Tops $1 Trillion Market Cap - TIKR.com But beyond the financial gains, there's a sense of optimism that these breakthroughs will translate into real improvements in people's lives.

This milestone isn't happening in a vacuum. Consider Pfizer's recent $10 billion acquisition of Metsera, another obesity drugmaker. The race is on, and that’s good news for patients. Competition breeds innovation, and that ultimately leads to better treatments and more accessible healthcare.

I saw someone on Reddit comment, “Finally, a company that’s actually trying to solve problems instead of just creating them.” That sums up the sentiment perfectly. People are hungry for solutions, and Lilly seems to be delivering.

A Future Where Healthcare is Proactive, Not Reactive

Eli Lilly's trillion-dollar valuation isn't just a number; it's a symbol of hope, a testament to the power of scientific innovation, and a glimpse into a future where healthcare is proactive, personalized, and accessible to all. This is the kind of breakthrough that reminds me why I got into this field in the first place, and I can't wait to see what comes next.

Related Articles

Gold Price Analysis: Today's Price, Key Metrics, and the Silver Correlation

Gold's Dizzying Climb to $4,000: A Sober Look at the Numbers Behind the Hype The numbers flashing ac...

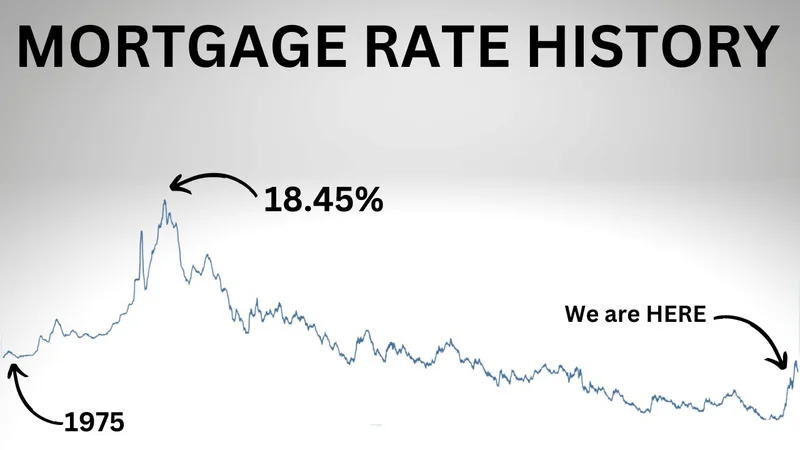

Mortgage Rates Today: What the Data Says

Okay, let's dissect this mortgage rate situation. The headlines are screaming about the "lowest rate...

Halliburton's Automation Push: Shell's Agreement and Investor Shock – What Reddit is Saying

Halliburton's Wall Street Glow-Up: Smoke and Mirrors, or a Real Turnaround? Halliburton's been getti...

Bitcoin's Latest Meltdown: Price Collapse, ETF Exodus & Why You Should've Seen This Coming

Alright, let's get one thing straight: I'm not a financial advisor, and if you're taking investment...

The Delivery Economy: Who's Actually Winning and the Real Cost of Convenience

Generated Title: UPS Admits Defeat, Crawls Back to USPS After Botched Delivery Strategy It’s being f...

Crypto Market Faces Headwinds: Analyzing the Macro Signals Driving the Dip

Generated Title: Bitcoin's Silent Standoff: Why a Sideways Market Masks a Brewing Storm The chatter...